Black History Month @ Harvard Business School

If you've ever skimmed an HBS brochure, stumbled across a page on their website, or had the (mis)fortune of speaking with an alumni (👋🏿) you've encountered an untold number of references to the vaunted "case method".

Harvard Business School (HBS) is an interesting place; situated in the snowy wasteland that many people refer to as Beantown- the institution is often called the "West Point of Capitalism"1. Yet, recently its rhetoric has slowly morphed to reflect a more conscientious form of capitalism. One in which shareholder supremacy cedes consideration to the many stakeholders impacted by the decisions that firms make.

If you've ever skimmed an HBS brochure, stumbled across a page on their website, or had the (mis)fortune of speaking with an alumni (👋🏿) you've encountered an untold number of references to the vaunted "case method". And undoubtedly the fact that over the course of a two year MBA, students will read 500 cases.. cases that are designed to walk them through unique strategic scenarios, test their critical thinking, and simulate being a decision maker at critical junctures in a business' lifecycle.

Lmao, what if this was an affiliate link & I got a cut of someone's tuition? 🤑

🕵🏿 Side Quest: Is HBS Obsessed With the Case Method?

TL;DR: yes.

I pulled the transcripts from every video that HBS has published on it's youtube channel over the past 16 years and counted how many times they mention the case method. And...

- They have published 1,401 videos 🙄

- In those videos, there have been 1,901 mentions of the case method for a nice ratio of 1.3 mentions/video

- 30% of all videos they have ever published mention the case method

This is almost guaranteed to be an underestimate because a lot of the video transcripts are way shorter than they should be given the length of the video and the code I wrote for finding mentions is admittedly simplistic and probably misses some edge cases.

Source code here: https://github.com/and-computers/youtube-hbs-analysis

Although the rhetoric surrounding the aims of an HBS education is changing, the cases used to educate students are almost always missing context or references to the ways in which the case's events impacted, or in some cases, were made possible by Black people.

So does HBS just not care about what they say they do? Discerning what an institution really cares about can be tricky. And, I think that in general we spend too much time thinking about whether or not institution X or organization Y cares about one cause or another.2

So instead of focusing on whether Harvard cares about highlighting the impact and outcomes for Black people as they relate to the cases that form the bedrock of the curriculum - we will be presenting...

Black Case Facts - Things We May Have Missed

The rest of the post is organized into sections, where each section focuses on one or two cases that were used in the first year of curriculum @ HBS circa 2021 give or take... uh 10 years. 🫥

The first part of each section just gives a short paragraph on what the case is about (usually verbatim from the author of the case). If you're reading this on the website and not an email, then you'll have to click the arrow to expand the heading and read that part. Each case also has a link to the official Faculty & Research page at hbs.edu if you're interested in seeing more.

The second section of each block contains The Black Stuff TM which is what we are all gathered here for today. 🙂

Whats this case about?

After highlighting some key developments in the banking history of the United States, the case illustrates the Banking Panic of 1933 and the way in which Franklin D. Roosevelt dealt with it at the beginning of his presidency. Describes the main components of banking reform bills that members of Congress proposed in April 1933. Deposit insurance figured prominently in these bills, and the case summarizes the contemporary debate surrounding this proposed insurance.

The Black Stuff TM

Many historians note that FDR’s popularity, sweeping New Deal legislation, and the relief it provided for many Black Americans in working class jobs is what laid the groundwork for the eventual change in allegiance of Black voters from the Republican to the Democratic party.

One large reason for Roosevelt’s popularity among Black Americans was the inclusion of ‘The Black Cabinet’, a group of prominent Black people who advised him on policies and the impact the potential impact they might have on the community. A few names of note:

- Mary McLeod Bethune; The only woman in the cabinet & also the founder of the HBCU Bethune-Cookman University in Daytona Beach, Florida.

- Robert C. Weaver; Economist who received a BA, MA, and PhD from Harvard University.

- Eugene K. Jones, one of the founders of the oldest (& coldest) Black intercollegiate fraternity in the world.

While the New Deal was generally seen as a successful piece of legislation it could not escape the racist origins of the country. Some provisions, such as the exclusion of agricultural and domestic workers (read: minorities in 1933), were included as concessions to Southern Democrats to get the bill passed in Congress.

Case: Cola Wars Continue: Coke & Pepsi

Whats this case about?

Examines the industry structure and competitive strategy of Coca-Cola and Pepsi over 100 years of rivalry. The most intense battles of the cola wars were fought over the $74 billion CSD industry in the United States, where the average American consumes 46 gallons of CSD per year. In a "carefully waged competitive struggle," from 1975 to the mid-1990s, both Coke and Pepsi had achieved average annual growth of around 10%, as both U.S. and worldwide CSD consumption consistently rose. However, starting in the late 1990s, U.S. CSD consumption started to decline and new non-sparkling beverages become popular, threatening to alter the companies' brand, bottling, and pricing strategies. The case considers what has to be done for Coke and Pepsi to ensure sustainable growth and profitability.

The Black Stuff TM

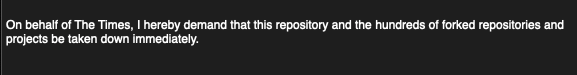

In 1947 the President of Pepsi hired Edward F. Boyd, a graduate of UCLA 🐻, who led an all-Black sales and marketing team. The team created the advertisement pictured below- one of the first without the offensive caricatures often employed in popular media that depicted Black consumers. The team's visits to cities with large Black populations like Chicago and Cleveland are credited with creating the first markets in which Pepsi overtook Coke.

Source: https://youngrestlesscreative.com/2017/02/07/young-restless-creative-in-history-black/

In 1965, H. Naylor Fitzhugh, one of the first Black graduates of Harvard Business School & the namesake of AASU's yearly conference, was hired by Pepsi as a VP of Marketing. He worked to establish the case for targeted marketing towards African-American buyers as a lucrative mass market and is often credited with being one of the first executives to perfect the segmented marketing approach in corporate America.

🚨In 2020 Nielsen cited that Black buying power topped $1 trillion (USD)! In the book referenced above, Dr. Jared Ball makes the argument that "Black Buying Power" was a concept fabricated by media companies (yes, Black ones3) to attract advertisers. The argument is that the concept of Black Buying Power was a label used to neatly package the Black consumer as they were served up to the highest bidding corporations in the pursuit of capturing advertising dollars. The pernicious impact of the propagation of that idea however, isn't that Black media companies attracted advertising dollars... it is the continued conflation of Buying Power with Political Power. They are simply put, not the same thing. Perhaps more harmful, is the tendency for the term to compel individuals to "buy Black" in an effort to effect change instead of engaging in the always-critical actions of political and community organizing.

I don't have the qualifications, depth, or range to do this topic justice, so here is a short excerpt from a much longer podcast episode in which Jared Ball interviews Mehrsa Baradaran who wrote The Color of Money: Black Banks and the Racial Wealth Gap. So for just 3 minutes of your time you can hear a much better articulated synopsis of what I'm trying to say.

Whats this case about?

On March 28, 2011, The New York Times website became a restricted site where most of the content was protected behind a "paywall." Users who exceeded the limit of 20 free articles per month were required to pay for either a digital or print subscription. The newspaper industry had been suffering from revenue declines over the past decade, and the transition to digital media was difficult to navigate. Revenues from online advertising were not sufficient to replace the loss of print revenue, and many publishers had explored charging readers for content, with mixed success, where specialized sources like The Wall Street Journal were successfully using the model, but several other general news sites had failed.

The Black Stuff TM

The media has always played an important role in conveying important events and analysis to the public to keep every day people informed. However, for Black people in America there is a long tradition of also having distinct sources of information created primarily to report on issues of specific relevance. The very first Black periodical was called Freedom’s Journal and was founded in 1827, almost 25 years before the New York Times (WAIT, DID I TELL YALL WE GOT A CEASE AND DESIST FROM THEM?!?4). Other significant newspapers were The North Star, founded in 1847 by Frederick Douglass, and the Chicago Defender- which played a huge role in facilitating and encouraging the mass movement of Black Americans from the South to major cities such as Chicago, New York, and Los Angeles in a movement referred to as the Great Migration.

In more recent times, many of these historically Black newspapers have unfortunately gone out of business, sometimes for lack of ability to attract advertising dollars. (See above discussion about Black Buying Power! Its nuanced!)

Others have persisted as largely digital publications and many others such as Black Voice News, The Root, and The Grio have emerged in more recent years.

Whats this case about?

Cumulus Media Inc., a leading radio broadcaster files for Chapter 11 bankruptcy and is attempting to renegotiate its loan terms to keep the company alive.

The Black Stuff TM

18 years prior to Cumulus Media’s founding, Catherine Hughes, an African-American woman, purchased a Washington D.C based radio station for just under $1 million dollars financed mostly through debt with some portions having an interest rate of over 15%.

"In 1980, Hughes purchased her first radio station, WOL-AM, in Washington D.C., and pioneered the format – '24-Hour Talk from a Black Perspective.' With the theme, 'Information is Power,' she served as the station’s morning show host for 11 years." Source: https://cathyhughes.com/about/

The difficulty of paying back the loans forced Cathy to eventually start living out of the radio station after having her house repossessed.

The content on her station was catered towards Black audiences, with a controversial talk show- which she hosted herself- and the “Quiet Storm” format she pioneered with Melvin Lindsey while first working at Howard University’s WHUR radio station.

In 1997 her son, who attended UCLA and Wharton took over as CEO and began a rapid expansion enabled by the Telecommunications Act of 1996. The playbook was to purchase underperforming stations and revamp the programming to focus on African-American listeners. In 1999 Radio One went public on the NASDAQ, making Catherine Hughes the first Black woman to chair a public company. Today Radio One is one of the ten largest Black owned businesses in America and owns a number of cable stations, over 50 radio stations, and a number of digital media assets.

Whats this case about?

Established in 2007, SoundCloud already boasted the second largest number of active music listeners among all streaming services and was recognized as the go-to platform for new artists by early 2014. Yet, its founders were questioning the robustness of the firm’s current focus on serving as a lab for emerging musical artists. They were wondering if the firm should instead enter the booming mainstream music streaming market.

The Black Stuff TM

A number of artists from Frank Ocean, to TLC, to Prince have alleged that record labels have for years engaged in egregiously exploitative contracts that entitle them to a disproportionate share of the revenue generated from musicians and long-term ownership of the music itself (in a near-future article, we are going to look at some of the hidden value in their music as it relates to branding).

Some important success stories of independent artist securing unusually attractive deals include Percy Miller (Master P)- who started No Limit Records and signed a distribution deal that allowed him to keep 80% of music revenue and 100% control of the music masters. Master P eventually expanded into a number of adjacent businesses including clothing, real estate, and sports management.

Another important success story can be found in South Central LA, home of the late great Nipsey Hussle. Nipsey spent almost a decade as an independent artist mastering creative marketing campaigns like #Proud2Pay in which he sold limited edition copies of his Crenshaw mixtape for $100 a piece, netting him $100,000 in 24 hours. With clear evidence of his sustained cultural relevance he was able to sign a deal with Atlantic Records in which he retained control of his music’s masters. His record label and expansive business ventures continue to inspire artists today.

I just wanted to include this.. umm put in headphones if you @ work.

Whats this case about?

This was a simulation used to illustrate how competition and supply chain decisions can impact business operations.

The Black Stuff TM

While we learned all about brewing beer and competitive dynamics during this simulation- what we didn't talk about was the story of the United State’s first Black Master Distiller, Nathan “Nearest” Green. Born enslaved in Tennessee and freed with the ratification of the Emancipation Proclamation, Nearest was hired by a distiller who employed a young Jack Daniels. The distiller knew of Nearest’s skills and instructed him to teach the younger Jack Daniels all he knew about distillation. When Jack Daniels opened his distillery years later his first hires were Nearest Green’s two sons, Eli and George.

In 2017, Fawn Weaver an African-American woman and author of a New York Times bestseller, founded the Nearest Green Foundation which honors the legacy of Green with a museum in Lynchburg Tennessee, a national park, and a whiskey line- Uncle Nearest Premium Whiskey- which has since become the bestselling African-American owned and founded spirit brand of all time and was the most-awarded American whiskey in 2019 and 2020.

Case: Jumia Nigeria & Angola Starts Now

Jumia Nigeria: Whats this case about?

Founded in 2012, Jumia Nigeria, a startup effort by Germany-based Rocket Internet, aimed to become an African Amazon. The company entered the nascent market and immediately enjoyed an uptick in consumer spending fueled by the strength of Nigeria’s oil-based economy. By 2016, however, Jumia’s growth had begun to taper, hindered by plummeting oil prices, the subsequent economic downturn, and the pressure of Nigeria’s limited retail ecosystem. In addition, Jumia’s inventory-intensive retail model required significant infusions of capital that, in the face of a deteriorating economy and the company’s inability to show a profit, was becoming increasingly difficult to obtain.

Angola Starts Now: Whats this case about?

After five centuries of colonialism, four decades of civil war, an extended experiment with Marxism-Leninism, and nearly four decades of rule by a single man, José Eduardo Dos Santos, Angola finally has a chance to realize its enormous economic potential. A country blessed with enormous resources of oil, gold, and diamonds, it also has some of the most fertile remaining untilled land in Africa.

Alright, since both of these cases are about business on the continent, they are already kind of about Black stuff, so:

The Black Stuff We Didn't Talk AboutTM

In the Jumia Nigeria case we talked about the difficulty of building a business in a country that lacked many of the institutions and infrastructure that exist in more “developed” countries. In "Angola Starts Now", the case deeply understates the role that colonialism played in slowing the development of GDP growth.

The incomparable Walter Rodney.

In 1972, Walter Rodney, a Guyanese historian and academic, published “How Europe Underdeveloped Africa” in which he analyzed the causes of the continent’s underdevelopment. In it he touches on the impact of depopulation by the European slave trade which removed critical labor from the economic growth equation. The impact of European monopolies on technology and innovation, which curtailed the opportunities for the development of internal and local trade. The difference in prices that were fetched for raw material exported from colonies in Africa when compared to raw materials sold from developed countries- he contends that this differential was forced upon colonies via political and military supremacy. Lastly, the imposition of education with the primary purpose to “… instill a sense of deference towards all that was European and capitalist...education for subordination, exploitation, the creation of mental confusion, and the development of underdevelopment”.

(finally something about computers 😅)

Case: Rapid7

Whats this case about?

That Corey Thomas, vice president at Boston-based Rapid7, Inc., was about to enter his investor’s boardroom to negotiate a potential acquisition of Metasploit, LLC, was already an unlikely achievement of sorts. After all, Rapid7 was a venture-backed, corporate client-focused cybersecurity company, and Metasploit was a white-hat hacker community with a reputation that ranged from esoteric to “notorious.” And awaiting Thomas for the deliberations wasn’t a typical business partner, but rather HD Moore, Metasploit’s founder, chief contributor, and in 2009 one of the most well-known hackers on the planet. The groundwork that had been laid to convince Moore to come to Boston for the discussions would all be for naught if Thomas couldn’t come to terms with Moore . . . and if Thomas couldn’t persuade his own executive team and board of directors that whatever package he ultimately agreed to with Moore was a reasonable one, even though an acquisition of Metasploit would come with no meaningful revenue and considerable execution, legal, and reputational risks.

Corey Thomas, who is now the CEO of Rapid7 is Black, so once again:

The Black Stuff We Didn't Talk AboutTM

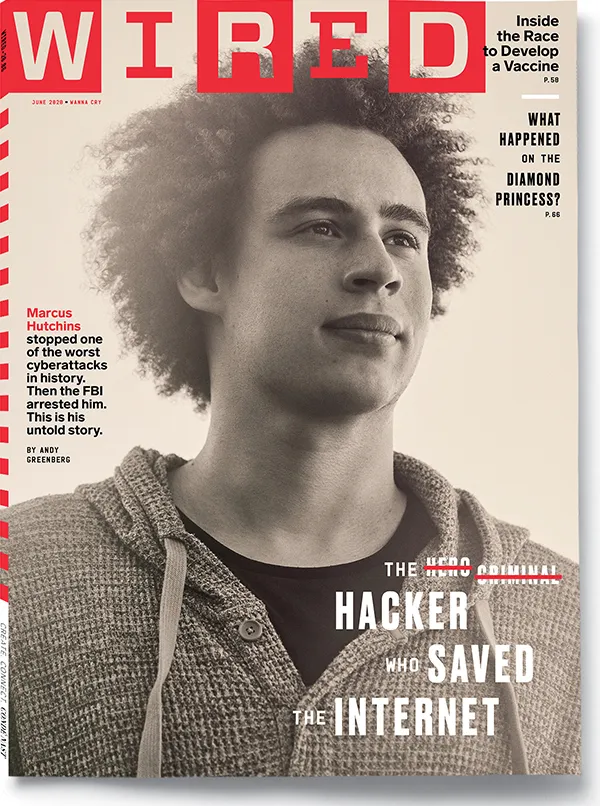

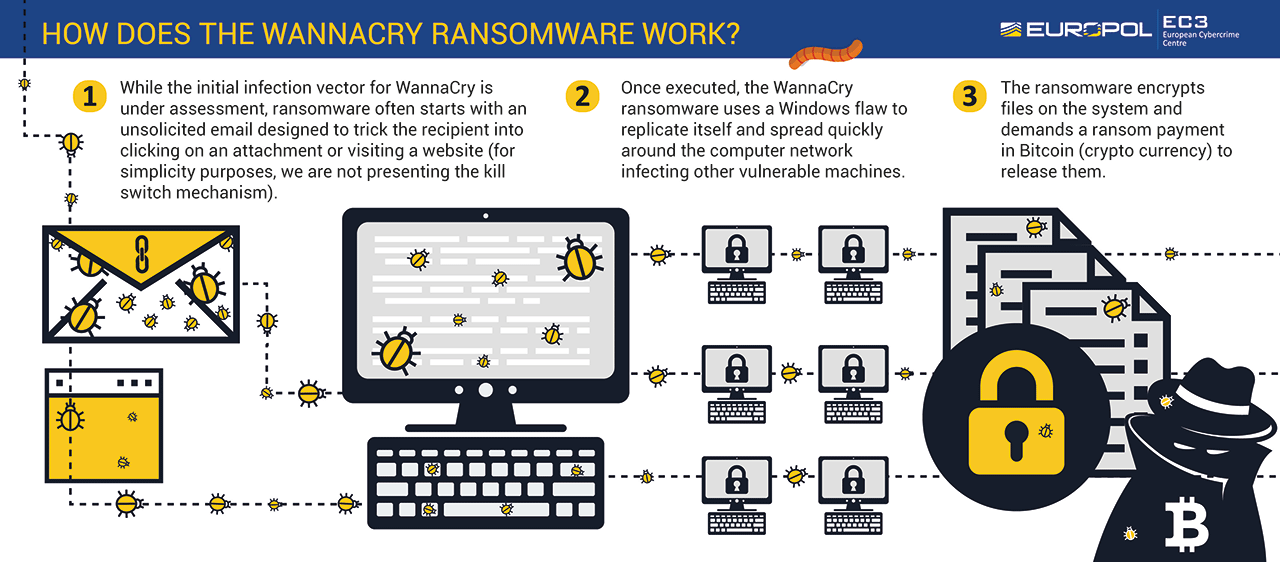

In May 2017, the WannaCry ransomware- targeting computers running outdated versions of Microsoft Windows OS, spread across the world to over 200,000 computers in 150 countries. The ransomware (allegedly originating from North Korea) used an exploit developed by the United States National Security Agency (NSA) that was stolen and leaked by an anonymous group of hackers.

After less than a week of spread and anywhere from hundreds of millions to billions of dollars in damages the attack was stopped by the discovery of a kill switch by the then 22-year old Marcus Hutchins- a Black British computer security researcher. He was later arrested by the FBI while in Las Vegas in connection with malware that he helped to create as a teenager that was designed for use in a number of bank fraud applications. Thankfully, the judge in his case was lenient as a result of his historical contribution in single-handedly stopping one of the worst cyber attacks in modern history and sentenced him to time served and a year of supervised release.

As always thanks for reading!

- There were a few other cases with The Black Stuff TM but the article was getting a bit long. Feel free to reach out if interested in seeing more.

- We have comments on the blog now, please leave some, say something if this was interesting!

- Smash the subscribe button if you haven't yet or please share with someone who you think might enjoy‼️

- Stay tuned.. a lot of these topics, specifically around music, business, economic power, and the interplay between them all are the focus of the next article ✍🏿

Footnotes

- I've never known if "West Point of Capitalism" was a tongue-in-cheek slight at the school or meant as a compliment? The investment, rigor, and discipline America applies to its defense (== imperialism?) but redirected squarely at perfecting capitalism.. 🤔 doesn't feel like a compliment, but I guess that depends who you ask 😅

- My take is that 10 times out of 9, institutions don't care about any externalities- but they will definitely contort their external presentation to fit the eddies and currents of their time & place.

- In 1954, Johnson Publishing Company, the owner of Ebony magazine financed the production of the 20 min film titled "The Secret to Selling the Negro" with that exact intent: attracting advertising dollars into their media assets that serviced Black audiences.

title is nuts 🥜

- Okay, okay, i just went back through my email to find the exact letter I got and it turns out it was a DMCA takedown notice. But it was for having the open-sourced code to the Black Wordle we made! article here. Mind you, I literally just cloned someone elses project and changed some words and added a couple features, but they sent it to all the people who forked from the original repository lol 👎🏿